*Disclaimer: This blog post is not a financial advice, nor connected with a recommendation to buy or sell shares, but an educational article for those who are interested to know about investing in the stock market.

The stock market isn’t a money-making machine. What you should realize is that you can lose a part or all of your money, regardless of what you invest in. Before you invest, it is important to determine— whether investing in the stock market is for you or not.

The first and foremost question you need to ask yourself is, ”Am I willing to take a certain degree of risk?”, if the answer is ‘no’— you can ask yourself, „How to turn your ‘no’ into a ‘yes’!“. Most people who haven’t invested before, lack knowledge and experience. So, I can recommend navigating through books and YouTube videos (which I will list below), so that you can learn the basics— how to start investing in the stock market.

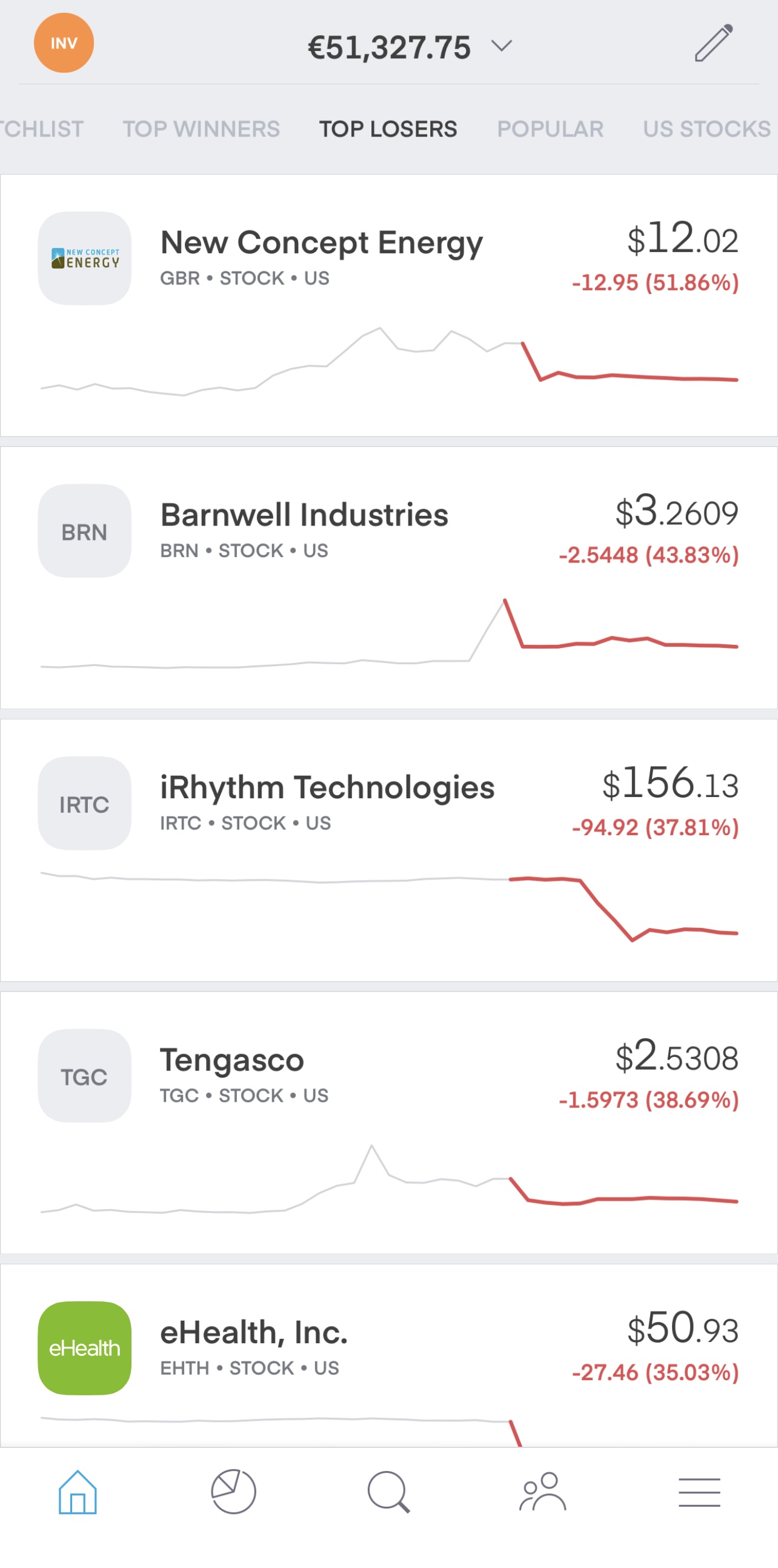

These are the risks to be aware of:

- Market risk: The investments will lose value on developments in the general economic situations. This means that the shares of a company will lose its value.

- Currency risk: You invest in a different currency (example: $ US Dollar), not your domestic currency (EUR). The exchange rate of the other currency falls compared to the domestic currency. This will have a negative impact on the value of your investments in the other currency.

- Credit risk: If the company cannot meet its payment obligations, it will go bankrupt. So, your investments will decline in value, and they will be gone.

Planning

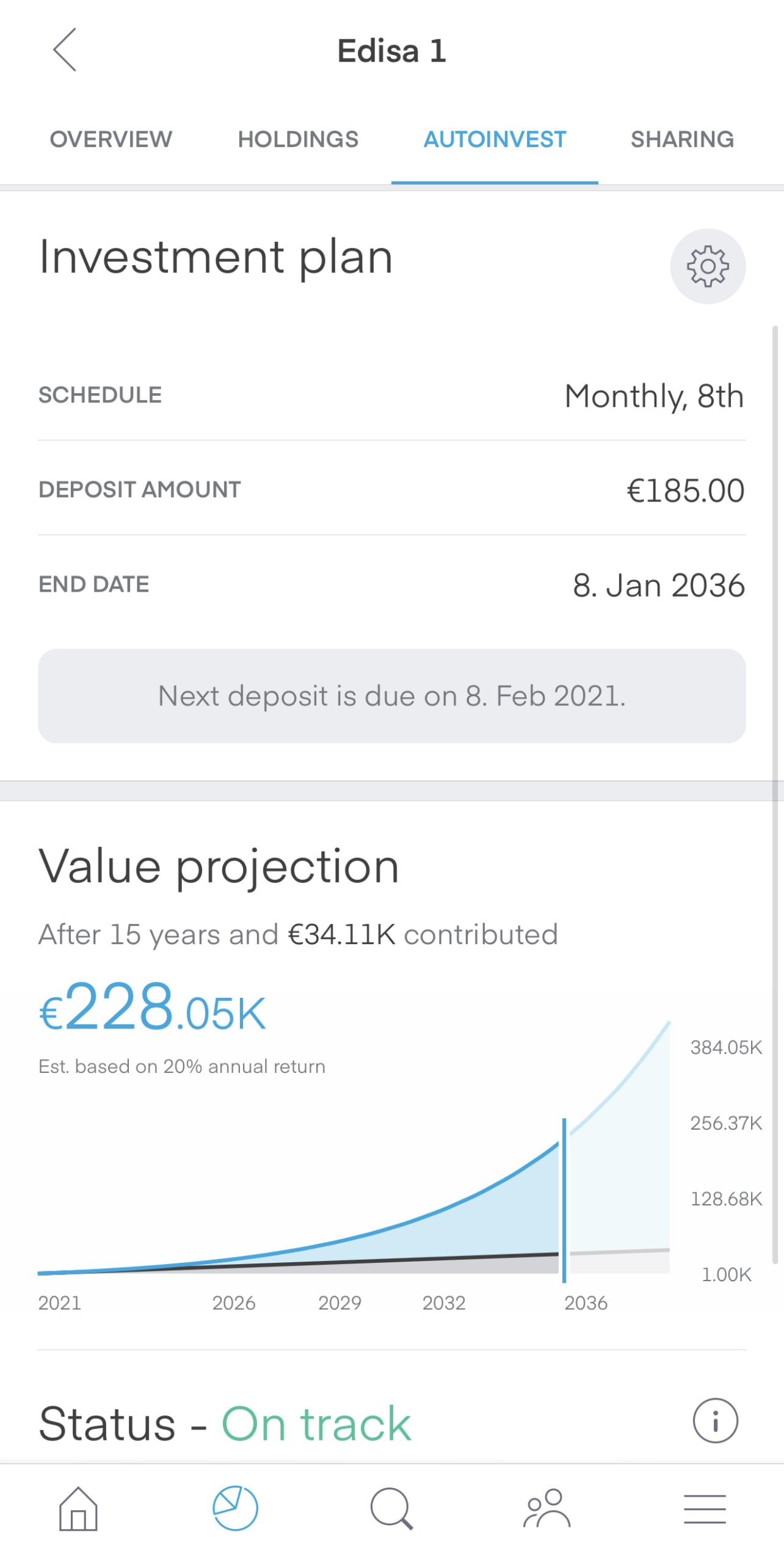

Before you start to invest, you need to think about: how long do you want to invest? How much do you want to invest? What is your goal?

The magic of investing is that, compound interests grow with the years. So, how long you invest, and how much you will have as a return.

An Example

Let’s plan the amount of investment for 5 years:

- Steve initially invests $1.000 and adds $100 monthly to his investment for five years with an estimated interest rate of 8%*. His total contribution will be $7.000, and his investment results will be $8.509.

Let’s plan the amount of investment for 10, 20 and 30 years:

- Steve initially invests $1.000 and adds $100 monthly to his investment for 10 years with an estimated interest rate of 8%. His total contribution will be $13.000 and his investment results will be $ 19.542.

- Steve initially invests $1.000 and adds $100 monthly to his investment for 20 years with an estimated interest rate of 8%. His total contribution will be $25.000 and his investment results will be $59.675.

- Steve initially invests $1.000 and adds $100 monthly to his investment for 30 years with an estimated interest rate of 8%. His total contribution will be $37.000 and his investment results will be $146.000.

*8% of interest has been taken, because over the last decade— the 20-year S&P 500 (the stock market index of the United States, where the 500 biggest companies of the US are listed) return was over 8%.

How do you want to invest?

You can invest yourself or by another party. When you decide that a financial advisor or a bank will invest for you, make sure you know about the costs.

If you are going to invest yourself, decide what kind of shares you want to invest in.

Here are some examples of shares:

EXCHANGE TRADED FUND (ETF) – this is an index that tracks the price of a selection of companies. You can choose between several ETF (Tech, S&P 500 etc.). If you do not want to take much risk, an ETF is an excellent opportunity, because you invest in a basket with several companies. However, ETF do not give much revenue as for example individual or growth stocks.

INDIVIDUAL STOCKS – this is a stock where you buy a single share, or a few shares of a company. You can divide individual stocks in the following stocks.

DIVIDEND STOCKS – this is a stock of a top value company. It is mostly seen as a safe and reliable investment. Companies mostly start to pay out dividends, when their growth curve is over and they have become a company with stable earnings.

GROWTH STOCKS – this is a stock of companies that are expected to increase their revenue and earnings faster than the average business. The risk attached to these companies are higher than dividend and ETFs. On the other hand, if the prospective growth really takes place, the revenue will be higher.

To spread your risks, you can decide to invest 50% in ETFs, 20% in growth stocks and 30% in dividend stocks. You can also decide to only invest in growth stocks, ETF or dividend stocks. It all depends on the risk you want to take and your goal.

Do your research

The most important thing is that you understand what a company is doing. What is their business model, who is in charge, and what is their expected growth? In another blog post, I will share how you can analyze a stock and if you want to invest in the company or not.

How do you want to invest?

Do you want someone else to invest for you or do you want to do it by yourself? If you want to do it by yourself, you need to choose an online broker. Below, I will give a broker that is good for beginners.

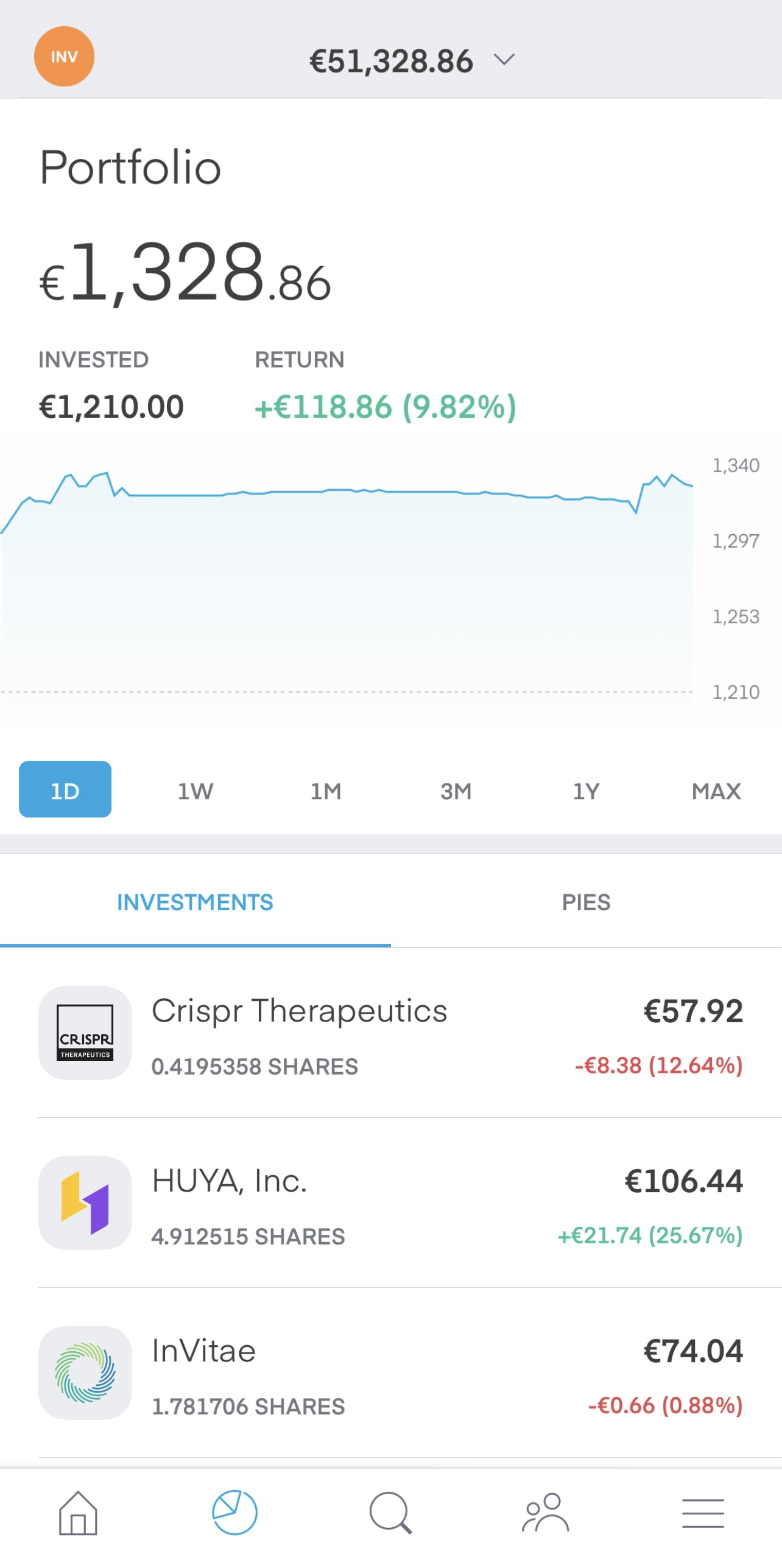

Trading212: although in this platform you can invest to trade via CFDs or shares— when you want to invest make sure you choose ”Trading212 Invest” instead of ”Trading212 CFDs”. If you just started with investing and don’t want to invest large amount of money— Trading212 Invest is a good solution, because it offers you to invest in fractional shares. This means that you can invest in a small amount of a share. It should be noted that with fractional shares you don’t own the share because it belongs to Trading212. However, for many people who start investing and don’t have a big budget this might be an option and its a personal choice to do so or not. If you don’t want to invest in fractional shares you can always choose to invest in shares or ETF’s which you can buy.

Screenshots from Trading212 App

Let’s have a simple example:

One Tesla share on 28th January 2021 is 864,16 USD. This means that if you want to own one share you need at least 865,00 USD. With fractional shares you can decide to buy a piece of this share. For example, if you have 216,00 USD you can buy 25%. Note that it is possible to even buy 5%.

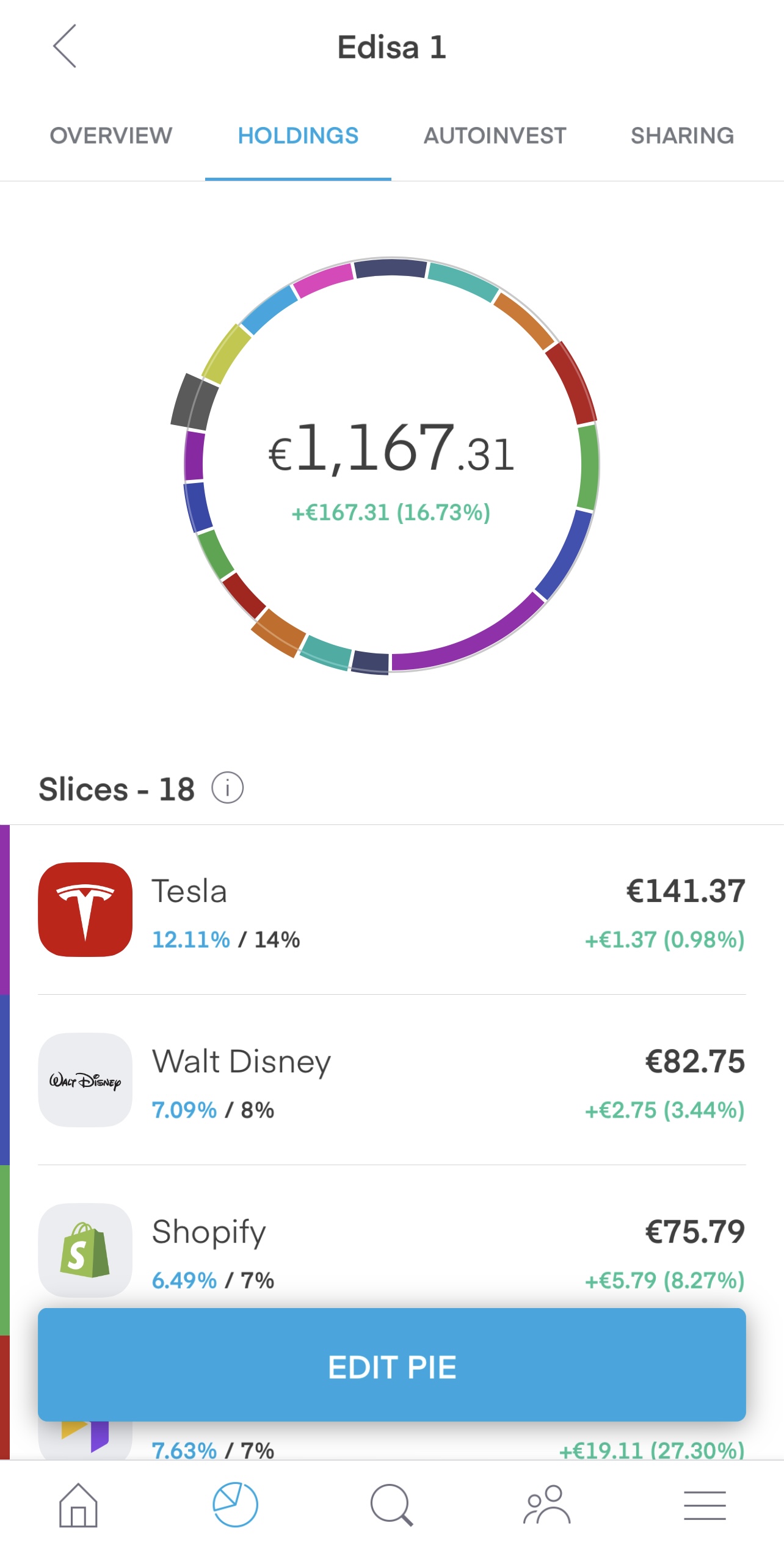

For beginners, Trading 212 offers a demo account which lets you try out the platform and perform test transactions without depositing money. The demo account gives you a great experience of how Trading212 works. Another great feature of Trading212 is that, you can create your own pie. This means that you can diversify your portfolio and this will be a slice of your portfolio (see the images below).

You may also have a look at other online brokers, such as: DeGiro, Interactive Brokers, TDAmeritrade. However, you can also consult your local bank advisor for your investments.

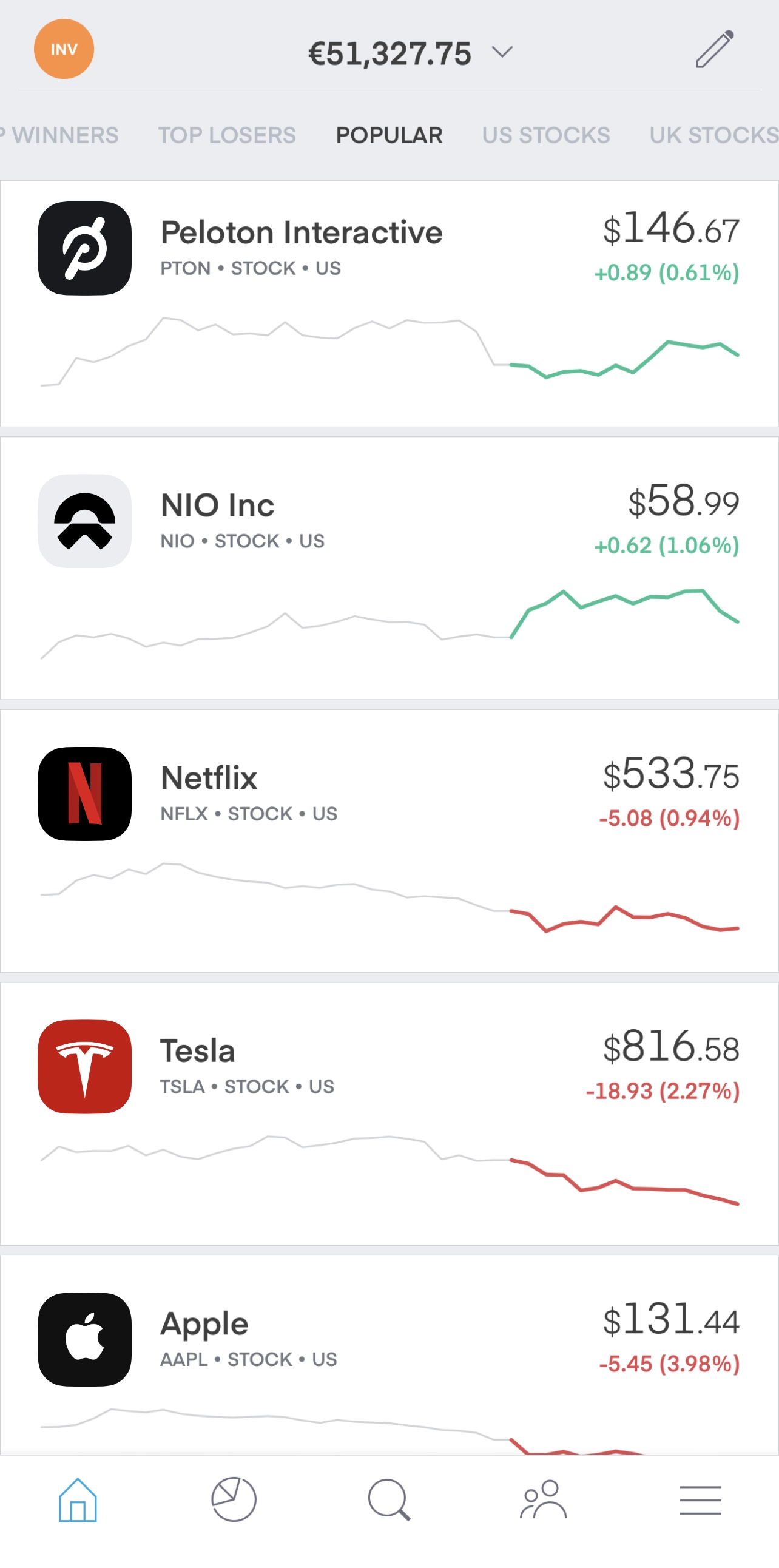

Screenshots from Trading212 App

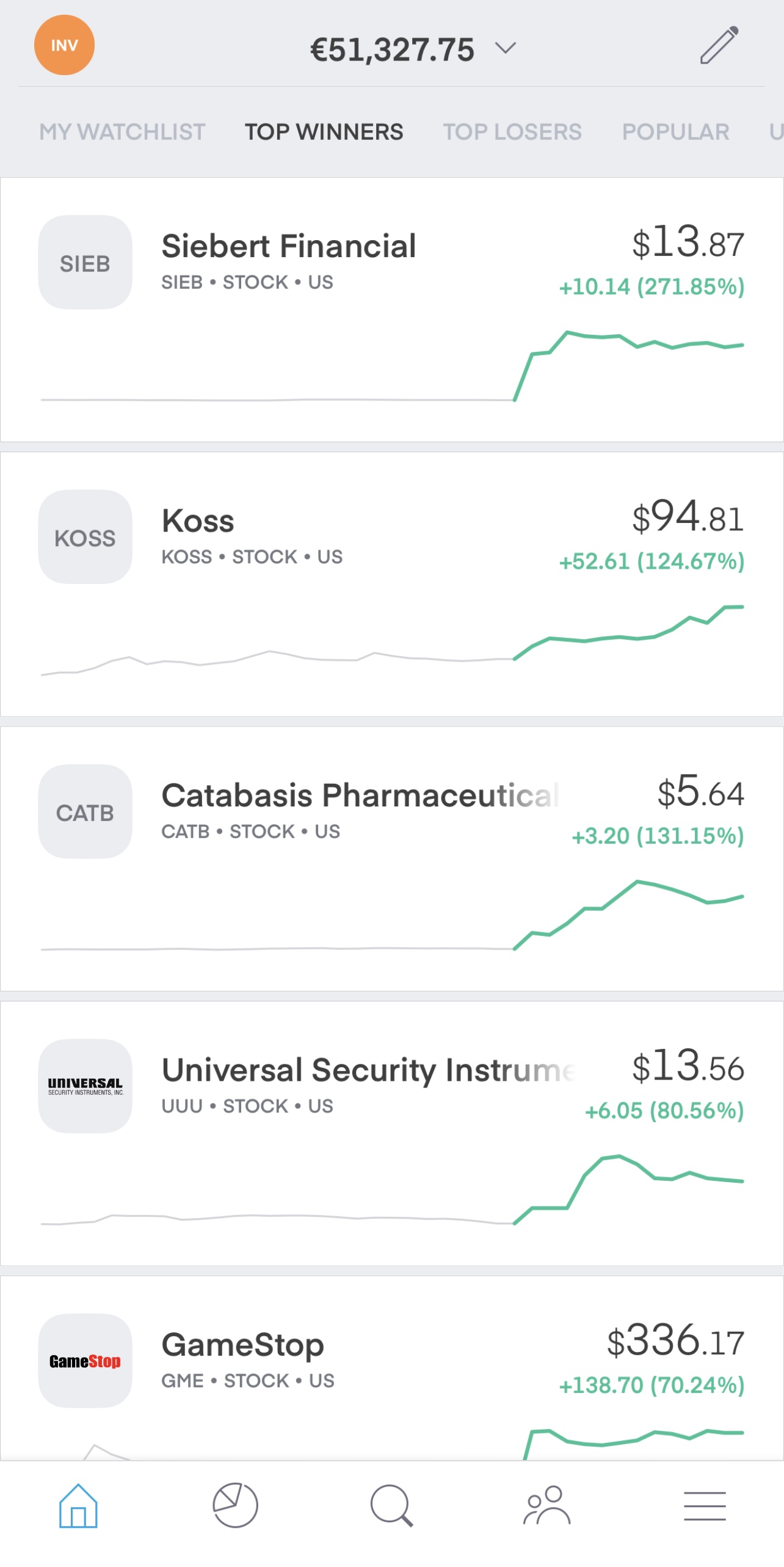

Screenshots from Trading212 App

Books worth reading:

YouTube videos worth watching:

Photos (c) DisiCouture

*Disclaimer: This post is 100% not sponsored nor it contains affiliate links.